Subtotals are a great way to “group” items together on an invoice in QuickBooks Online.

They can make longer invoices easier to read.

Adding subtotals to your invoices is very easy, let me show you how it’s done.

Quick Instructions:

- Add products/services to an invoice

- Click the Add subtotal button

- Continue adding items and subtotals as needed

Keep reading for a complete walkthrough with screenshots:

Adding Subtotals to Invoices

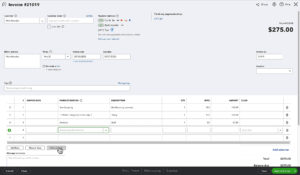

On the QuickBooks Online Invoice screen there are three buttons below the item list.

These are:

- Add lines – adds a new line to the invoice

- Clear lines – clears everything from the invoice

- Add subtotal – adds a subtotal line to the invoice

That subtotal button is what we’re looking at today.

Above is a screenshot of an invoice that I’ve added several items to.

After clicking the subtotal button a new line appears. To the right, it says Subtotal with a dollar amount equal to the cost of the items above it.

If I add more items to the invoice and click Add subtotal again it will only add up the cost of the items added after the last subtotal.

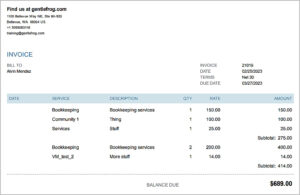

Here’s an example of an invoice with two subtotals, you can see the Total at the bottom is equal to the two subtotals.

If you send a PDF copy of the invoice to a client/customer the subtotals will appear on the invoice. Here’s an example of what that looks like:

It’s that easy to add subtotals to your invoices!

☕ If you found this helpful you can say “thanks” by buying me a coffee… https://www.buymeacoffee.com/gentlefrog

If you have questions about subtotals on invoices in QuickBooks click the green button below to schedule a free consultation.

5 Responses

The ‘add subtotal” button does not appear on the invoice form I see. We are using QBO Essentials. Is the subtotal button only available on QBO Plus or Advanced?

They’ve removed the separate Add Subtotal button on the new invoice layout. To add a subtotal click “Add product or service” and one of the options is subtotal.

-Jess

Thank you. I found the subtotal options thanks to your advice.

how could i subtotal all column QTY ,RATE , AMOUNT

That’s not an option, it only subtotals the amount. If that’s a feature you’d like added please click the gear in the upper right corner, under PROFILE click Feedback and let Intuit know what features you’d like them to add to the software.

-Jess