In this tutorial, I’ll show you two different methods for recording business expenses paid personally in QuickBooks Online.

Quick Instructions:

Method #1 – Journal Entry

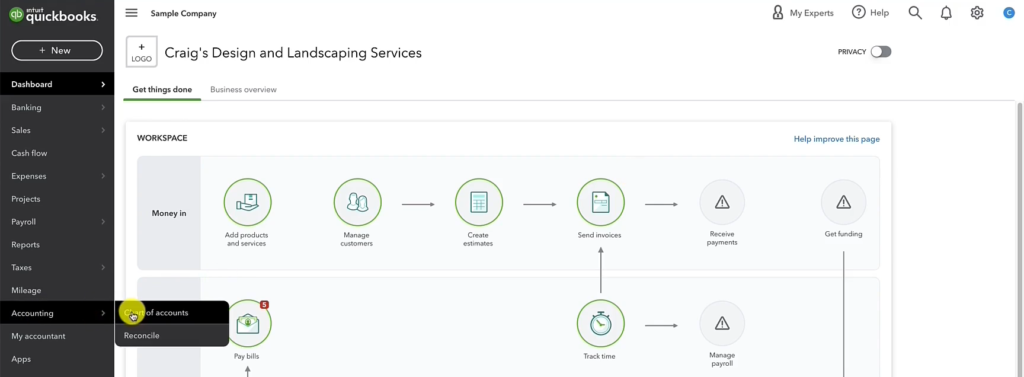

- Click Accounting -> Chart of Accounts in the left side menu

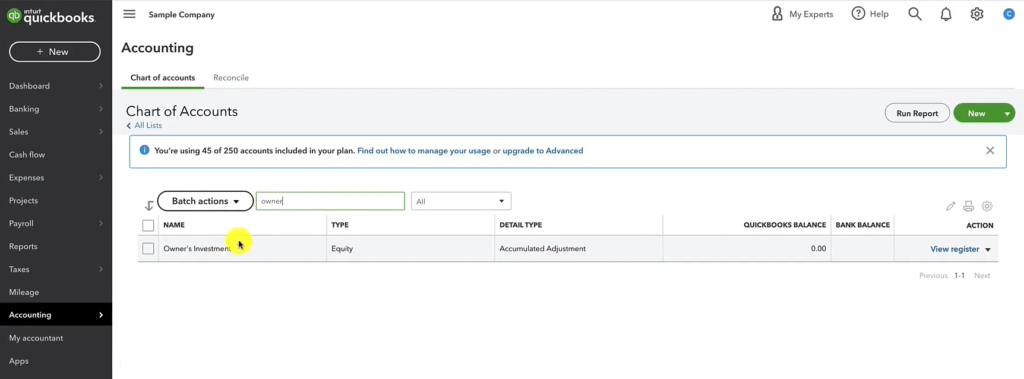

- Search for the Owner’s Investment account

- Click View Register on the right

- Click Add journal entry

- Fill in the transaction details:

- DATE: Date of the transaction

- REF NO. TYPE: Optional

- PAYEE ACCOUNT: Who was paid

- MEMO: Optional

- INCREASE/DECREASE: Amount of money added or removed from the account.

- ACCOUNT: The payee account this falls under.

- Click Save

Method #2 – Petty Cash Account Expense

- Click Accounting -> Chart of Accounts in the left side menu

- Click the green New button

- Create a Petty Cash account

- Account Type: Bank

- Name: Petty Cash

- Detail Type: Cash on hand

- DESCRIPTION: Optional

- Click the Save and close button

- Click View register for the Petty Cash account

- Click Add check

- Select Expense from the drop-down

- Fill in the transaction details:

- DATE: Date of the transaction

- REF NO. TYPE: Optional

- PAYEE ACCOUNT: Who was paid

- MEMO: Optional

- PAYMENT: Amount spent

- ACCOUNT: The payee account this falls under.

- Click Save

- In a month or year (your choice) navigate to your Petty Cash account in the Bank Register

- Click the Add expense drop-down and select Deposit

- Enter Owner’s Investment as the Deposit account

- Deposit amount should equal the Ending Balance of the account in the upper-right-hand corner

- Click Save

Keep reading for full instructions with screenshots.

Owner’s Investment Journal Entry – Method #1

The first method uses Journal Entries entered into the Owner’s Investment account in the Bank Register.

To find this account click Accounting in the left-hand menu and select Chart of Accounts.

Search for the Owner’s Investment account.

You may have a different name for this account in your QuickBooks. Search for whichever account you use for logging money you’ve personally invested into your business.

Click View Register on the right-hand side.

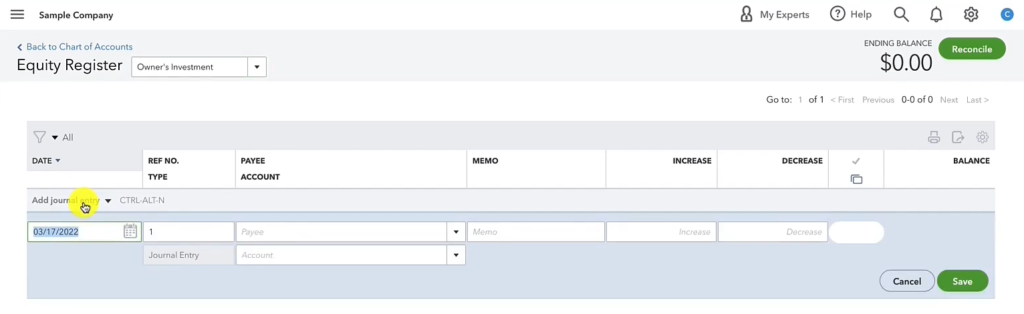

In the Equity Register click Add journal entry.

The Journal Entry will appear on the screen.

Fill in the details of the transaction:

- DATE: Date of the transaction.

- REF NO. TYPE: Optional, often used for check numbers.

- PAYEE ACCOUNT: Who was paid.

- MEMO: Optional, used to note why the money was spent.

- INCREASE/DECREASE: Amount of money added or removed from the account.

- ACCOUNT: The payee account this falls under.

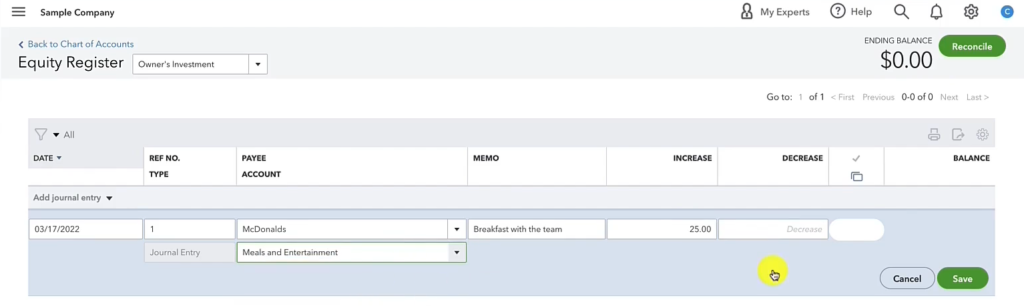

In my example I’m increasing the Owner’s Investment by $25.00 for a “breakfast with the team” at McDonald’s that’s classified as “Meals and Entertainment.”

Click the Save button when you’ve finished.

This is the shorter, faster, easier way to record these transactions. However, it’s not always the best way.

Petty Cash Bank Account – Method #2

The second method uses a Petty Cash bank account.

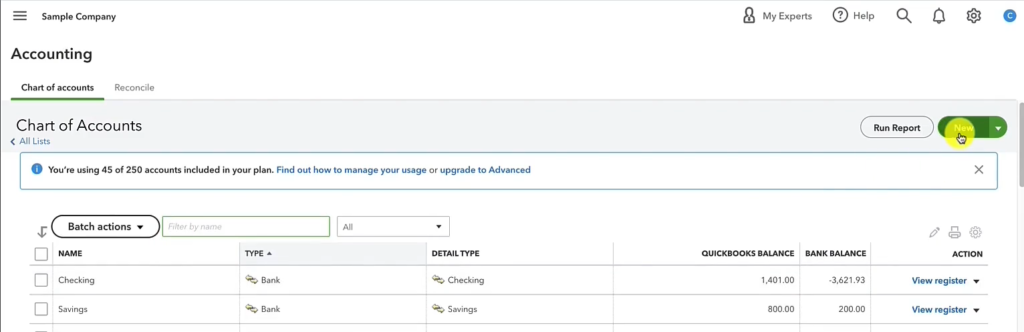

Navigate to the Chart of Accounts like we did for the first method. Click Accounting -> Chart of Accounts in the left-hand menu.

To create the Petty Cash account click the green New button on the upper right side.

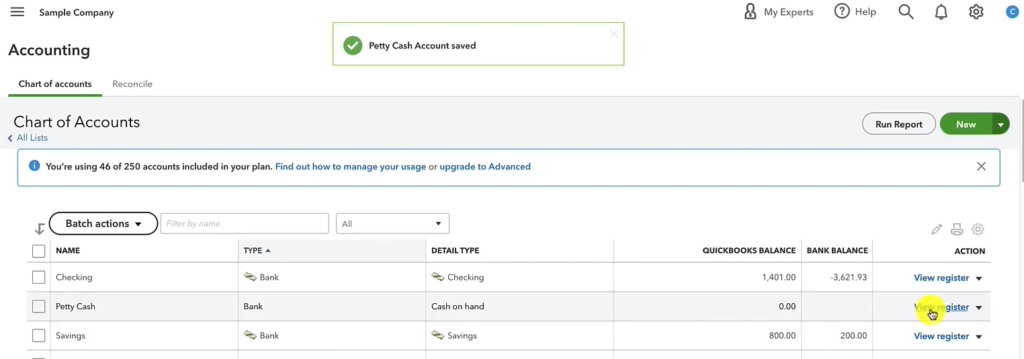

Create the Account by entering the following:

- Account Type: Bank

- Name: Petty Cash (you can name it whatever you’d like)

- Detail Type: Cash on hand

- Description: Optional, you can write your own description if you’d like

Click the green Save and Close button.

Your new Petty Cash account will now appear in the Chart of Accounts.

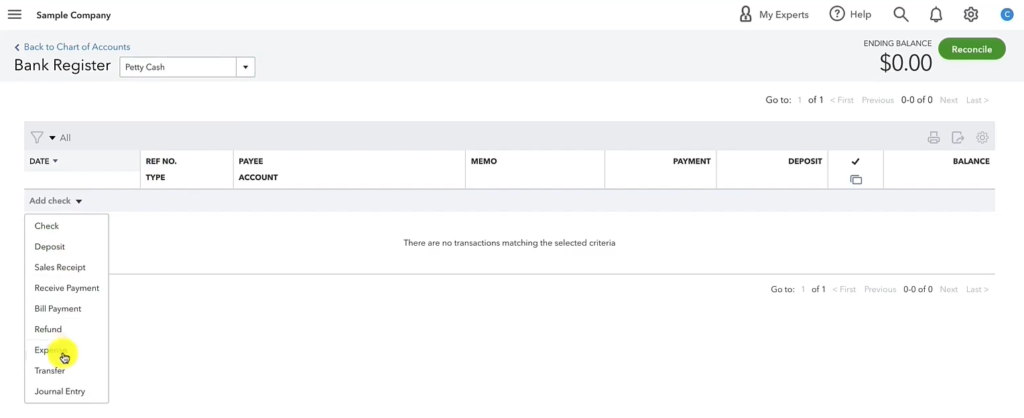

Click View register on the right for the account.

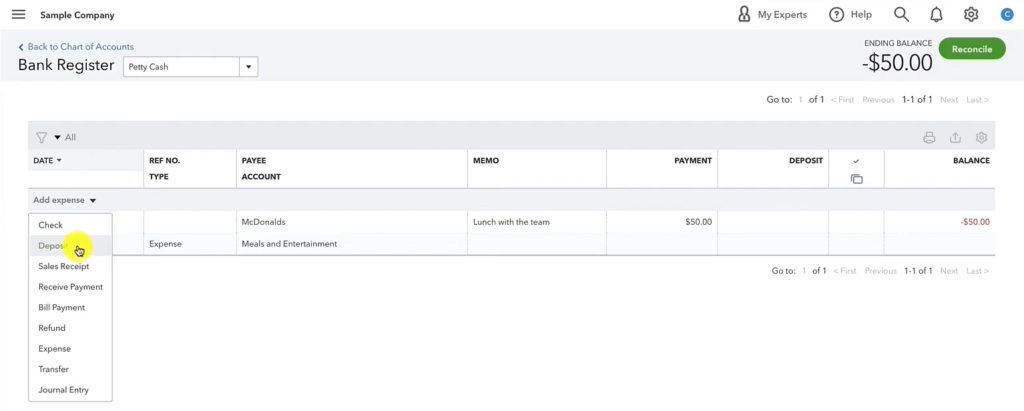

Click Add check on the left and then in the drop-down select Expense.

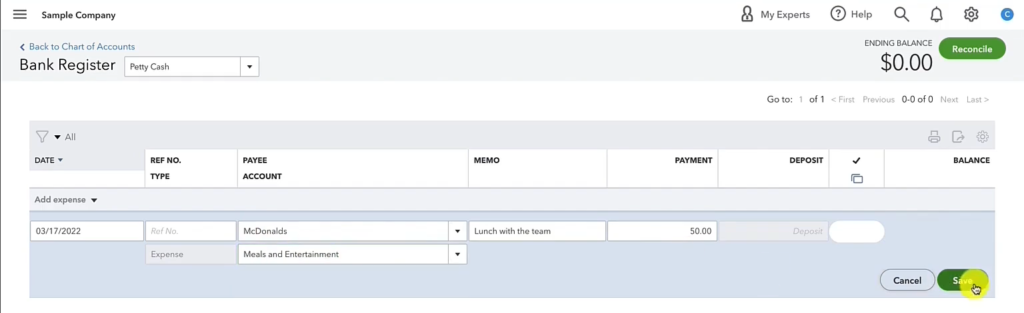

Fill this in like we did for the first method. The only difference is there is no INCREASE/DECREASE. Instead, there’s only PAYMENT.

For this example I’m making a payment of $50.00 for a “Lunch with the team” at McDonald’s that’s being classified as “Meals and Entertainment.”

Again, click the green Save button when you’re finished.

With the Petty Cash account, you’ll wait a period of time, a month, or a year (you decide).

Then you’ll go into your Petty Cash’s register and add a deposit.

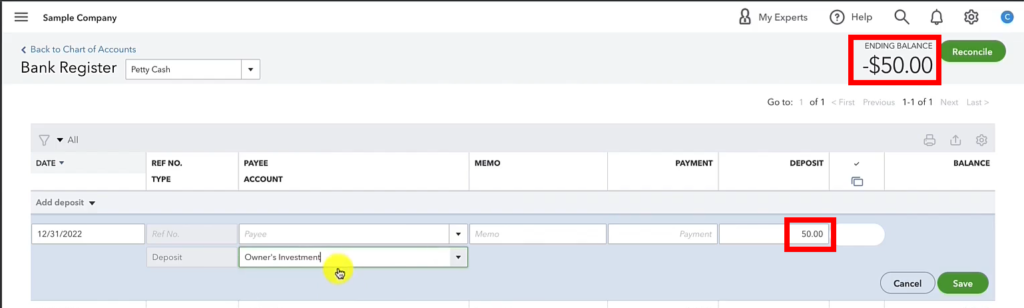

To do this you’ll click the Add expense drop-down and select Deposit.

The amount will be how much the negative Ending Balance is in the upper-right-hand side of the screen.

The Deposit account will be Owner’s Investment.

This is recording that you’re depositing money from your personal account into your business.

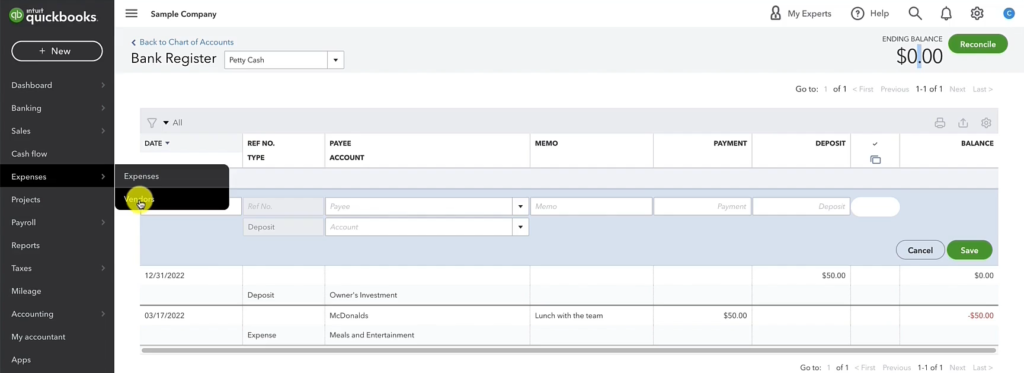

Click the Save button and the Ending Balance for the Petty Cash account should go to $0.00.

Advantages & Disadvantages of Each Method

While the first method is definitely easier it’s not as easy to find individual transactions.

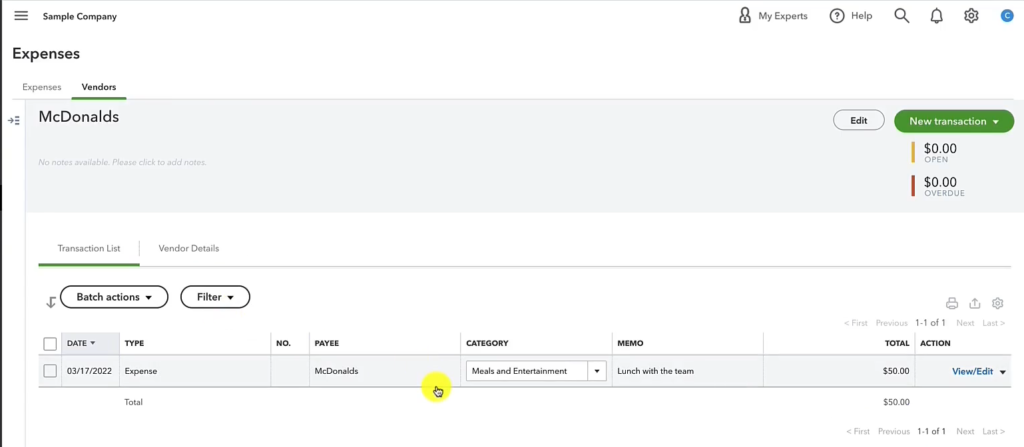

Using the second method I can easily find out how much money I spent at McDonald’s or how many McDonald’s expenses I have.

To do this click Expenses then Vendors in the left side menu.

I search for McDonald’s and it shows all my McDonald’s transactions.

In my example, I only see the “Lunch with the team” transaction that used the Petty Cash account method. Not the “breakfast with the team” that used the Journal Entry method.

If you think you’ll want to be able to see these transactions within your regular list of transactions then definitely use the Petty Cash method.

There’s no easy way to find the transactions from the Journal Entry method.

You can click the gear in the upper right-hand corner. Then search for McDonald’s and it shows the Journal Entry in the list of transactions it brings back. But, you need to click on that Journal Entry to see the details of the transaction. It’s not very intuitive.

You now know how to record your business expenses paid personally in QuickBooks Online.

☕ If you found this helpful you can say “thanks” by buying me a coffee…

https://www.buymeacoffee.com/gentlefrog

Below is a video if you prefer to watch me show you how to do this.

If you have any questions about recording these types of transactions or need any help with your QuickBooks click the green button below to schedule a free consultation.

3 Responses

Hello – I found your tutorial extremely helpful. Would you do anything different if you did not pay back your personal account in full yet? For example, I spent $50 at McDonald’s via credit card, but only paid $25 when the monthly bill was due.

Hi SJ,

How much you’ve paid back to visa is irrelevant. We are only talking about recording the expense (in this case McDonald’s). You track the expense when it happens, not when you can afford to repay yourself.

-Jess

How do you record the transaction when you pay your personal Visa with your business checking? As Owner Investment?