Let’s start by demystifying journal entries. A journal entry is just another bookkeeping tool to record financial transactions in your accounting system.

Journal entries are often used when you need to capture complex transactions that don’t fit neatly into the standard invoicing or expense categories. For instance, adjusting entries for accrued expenses, recording depreciation, or recording payroll.

They’re super handy for keeping your financial records accurate and up-to-date. It’s all about making sure every dollar in your business is accounted for.

Quick Instructions:

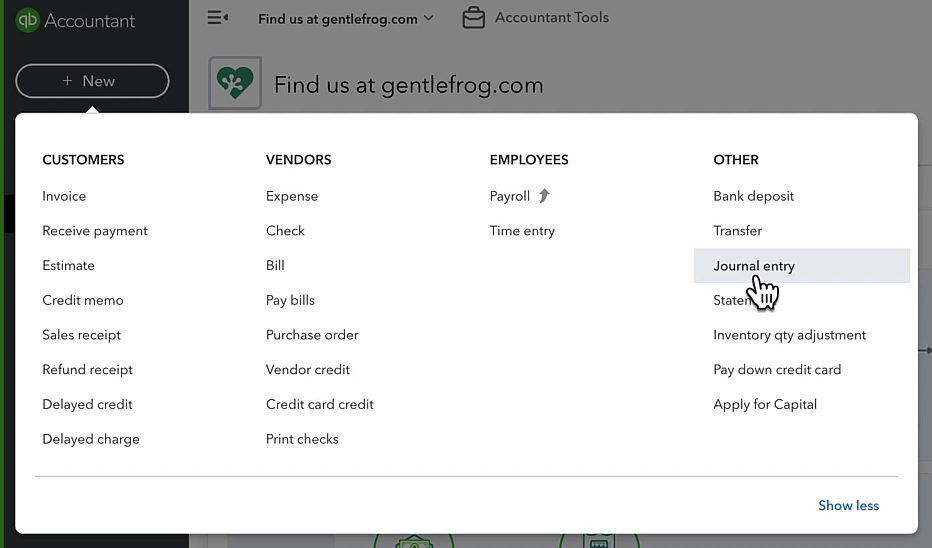

- Click the +New button in the left side menu

- Under OTHER click Journal Entry

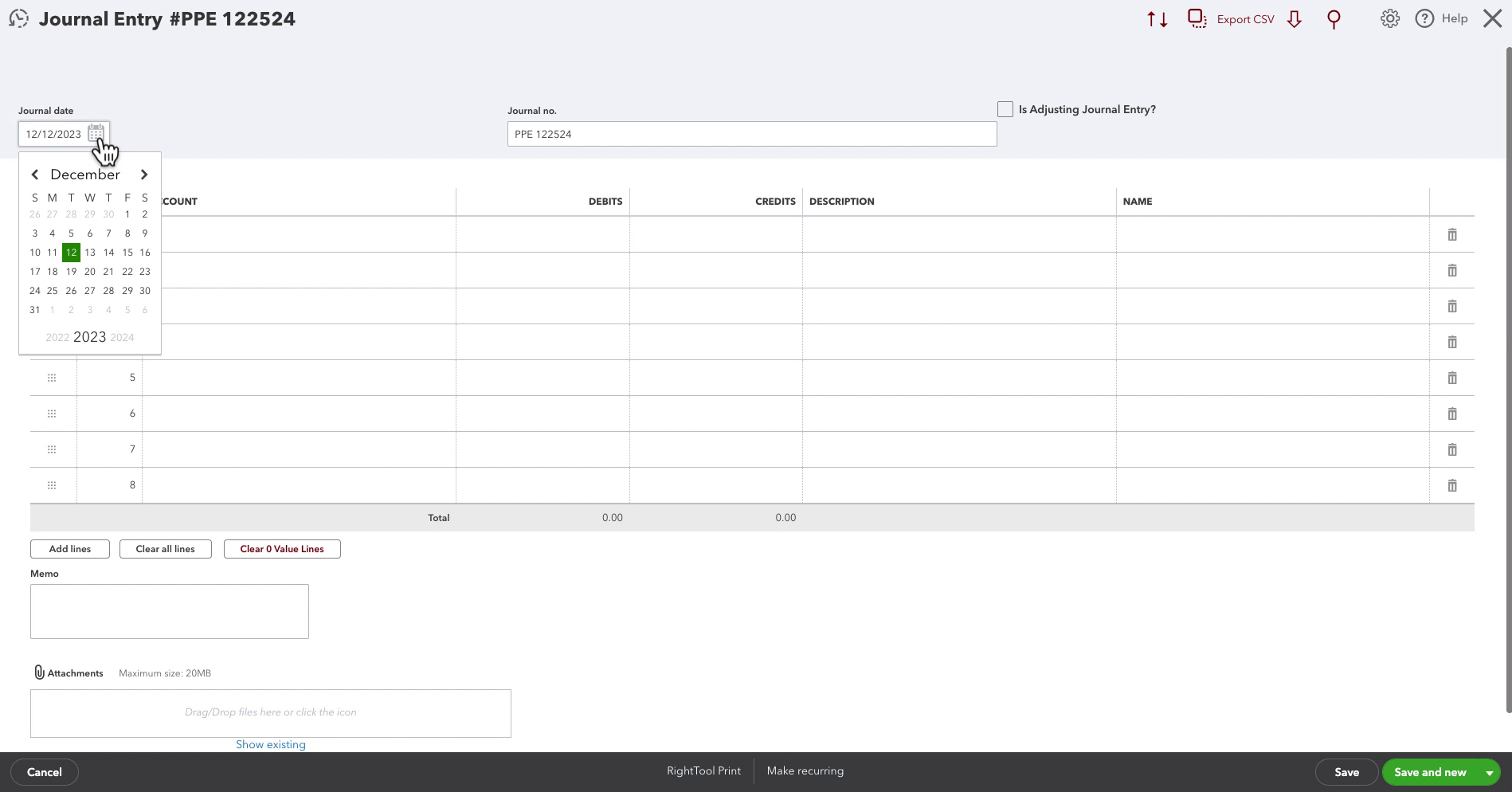

- Enter the Journal date

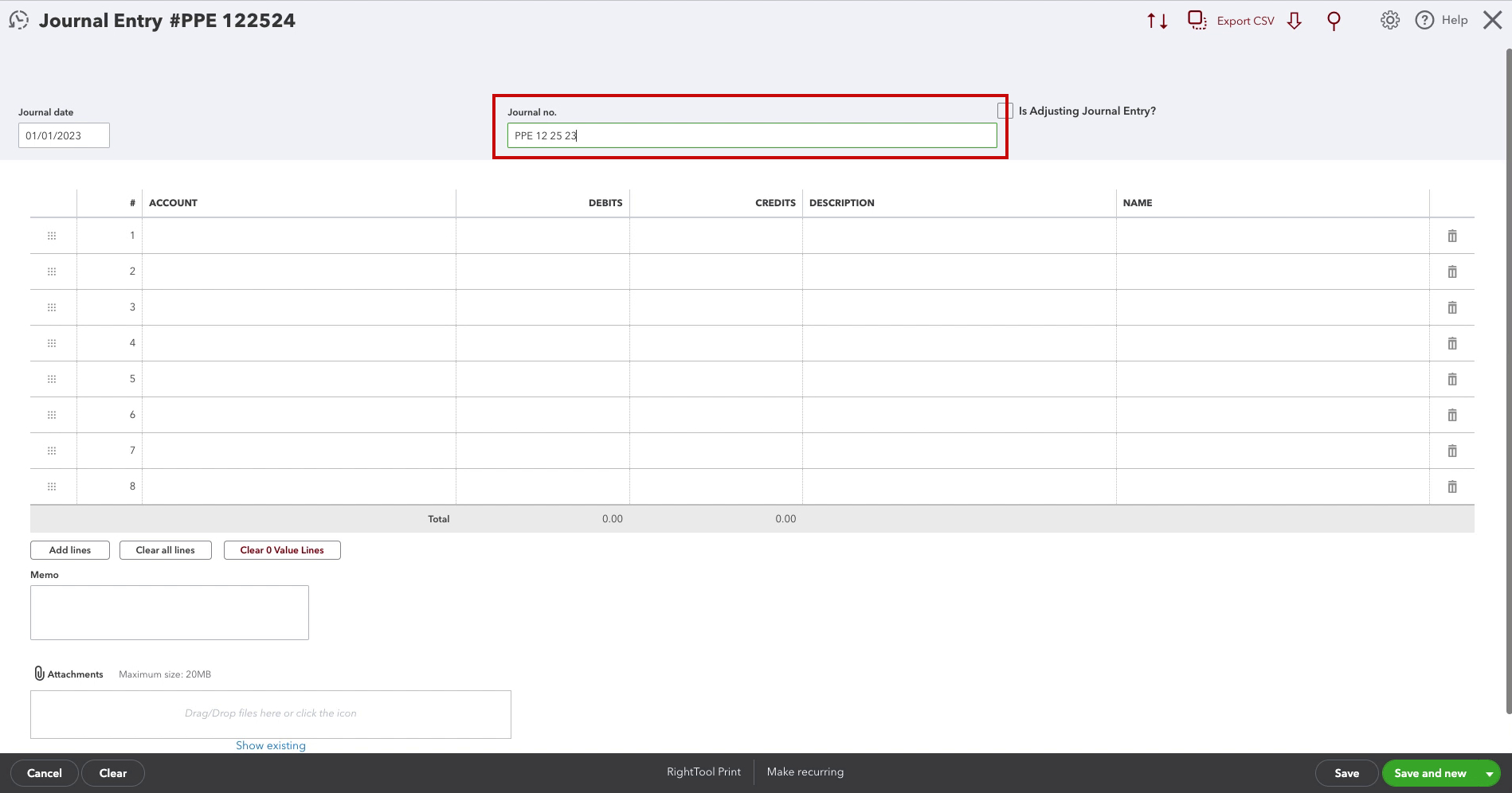

- Enter the Journal no.

- Fill in as many lines as you need (the debits and credits must be equal)

- Click the Save button

Keep reading for a complete walkthrough with screenshots:

Creating a Journal Entry

To create a journal entry click the +New button at the top of the left side menu.

In the OTHER column click Journal entry.

First, select the Journal date.

Next, enter a Journal no. this will identify the journal entry. QBO will automatically fill this incrementing it by one from the last number you used.

For this example I’m entering Payroll so I enter PPE and then the date of the payroll. You can use whatever works for you and the information you’re entering.

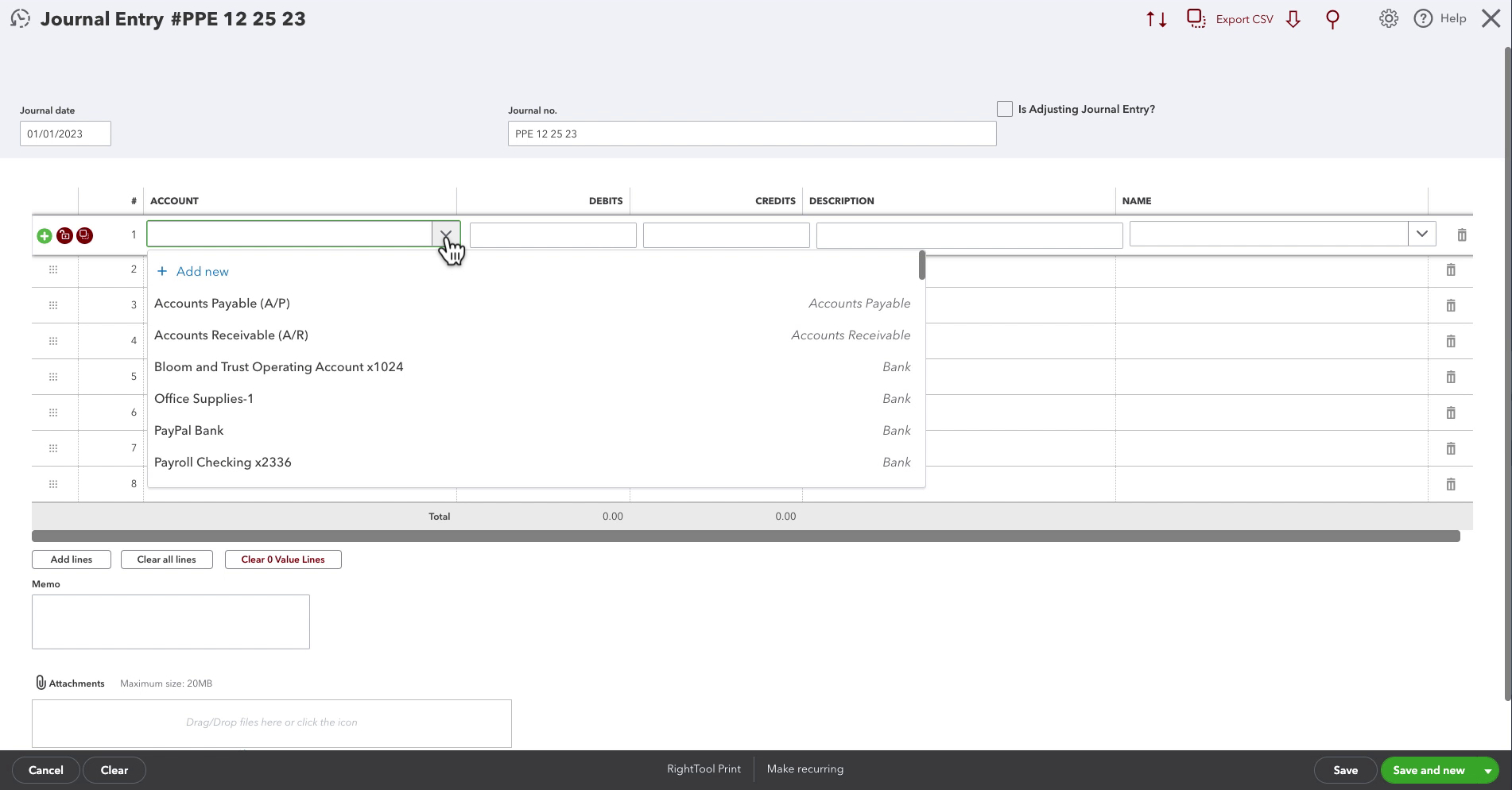

You can add your debits and credits and as many accounts as you need.

Description is optional but can be handy if you want to remember what a line is for.

Name is also optional, when you click on this field you can select a customer/vendor to associate with the line.

Like other transactions in QBO you have the option to add a Memo and an Attachment.

When finished your journal entry must balance. This means the debits must equal the credits in the Total at the bottom.

When finished creating your journal entry click the green save button in the lower right.

Example Journal Entry

Here is a simple example of a payroll journal entry:

This journal shows that there was $500 worth of employee wages.

From that $500, $100 was set aside for taxes in the Payroll Liabilities account.

The rest of the money comes out of the checking account and goes to the employee for direct deposit.

At the bottom of the journal entry, you can see both the debits and credits equal 500.00.

☕ If you found this helpful you can say “thanks” by buying me a coffee… https://www.buymeacoffee.com/gentlefrog

If you have questions about journal entries in QuickBooks Online click the green button below to schedule a free consultation.