Have you ever looked at your Profit and Loss and realized that something isn’t quite right?

The income is suspiciously high. Something got duplicated somewhere.

In this blog post, I’ll show you a few different methods for finding duplicate income. Then, how to fix it so your income on your Profit and Loss report is correct.

Quick Instructions

Search for doubled income:

- Open the Profit and Loss Report

- Click the dollar amount on the Total Income line to open the Transaction Report

- Sort by Transaction Type

- Search for Deposits

- View the Transaction List for the customer associated with the Deposit. Is there a payment matching the deposit amount?

- Double-check the bank register for the account the money got deposited into. Do you see doubled income?

Fix doubled income

- Open the Payment

- Change the Deposit to to Undeposited Funds

- Click Save and close

- Click Yes on the warning message pop-up

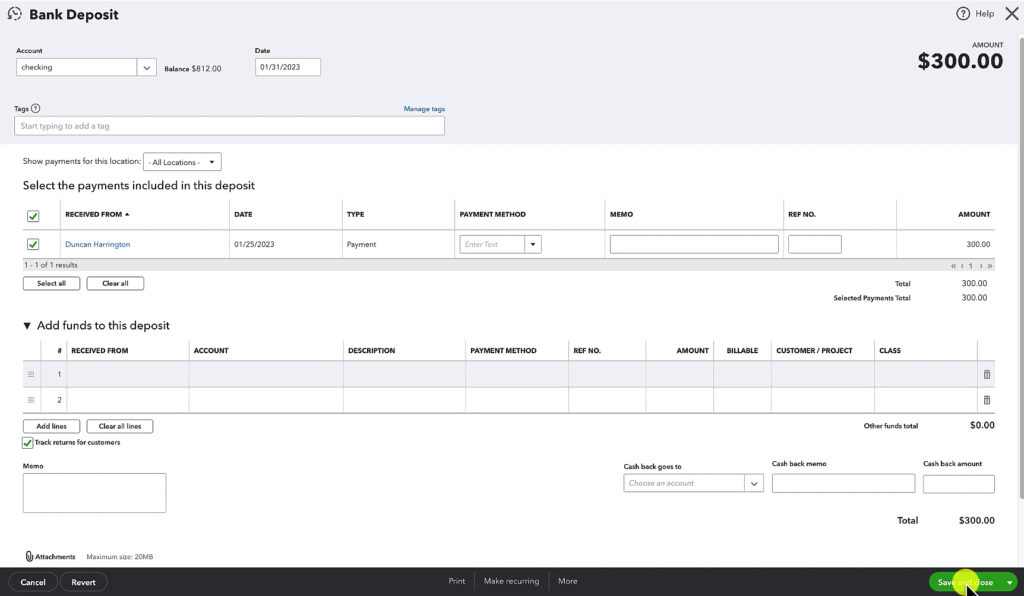

- Open the Bank Deposit

- Check off the Payment under Select the payments included in this deposit

- Delete the payment Under Add funds to this deposit

- Click Save and close

- Click Yes on the warning message pop-up

Keep reading for a complete walkthrough with screenshots:

Profit and Loss Report

Let’s start by finding that doubled income in the Profit and Loss report.

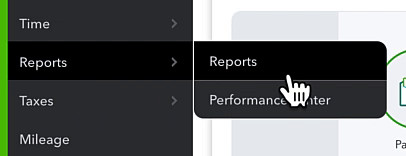

To navigate to your Profit and Loss report click Reports in the left-side menu.

Then open the Profit and Loss report. You have it in your Favorites up at the top. Or, you can use the search bar to find it.

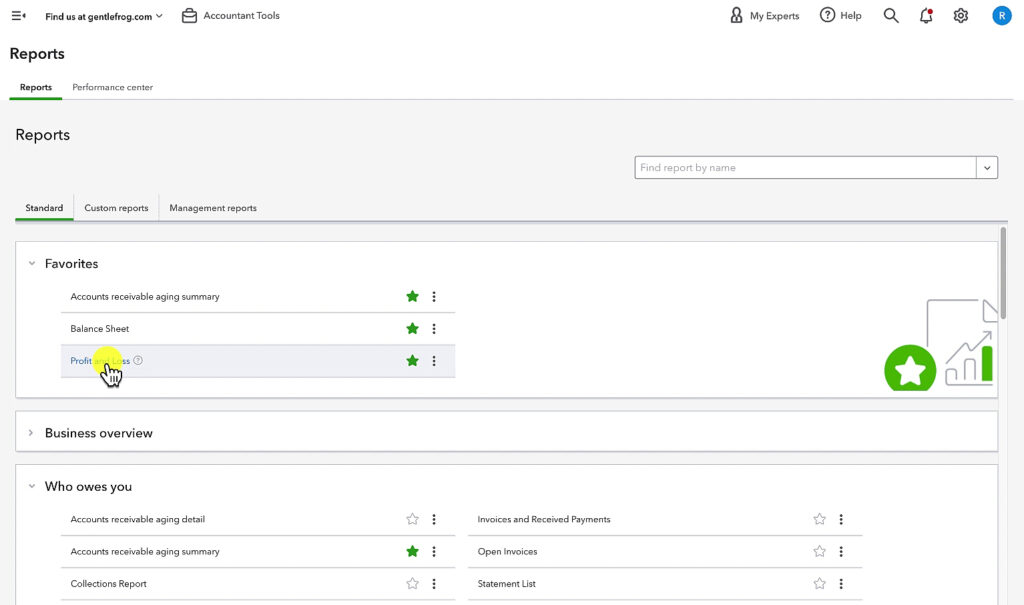

Your income is at the top of the Profit and Loss report. If it looks too high you can drill down further. Click the dollar amount across from Total Income to open the Transaction Report.

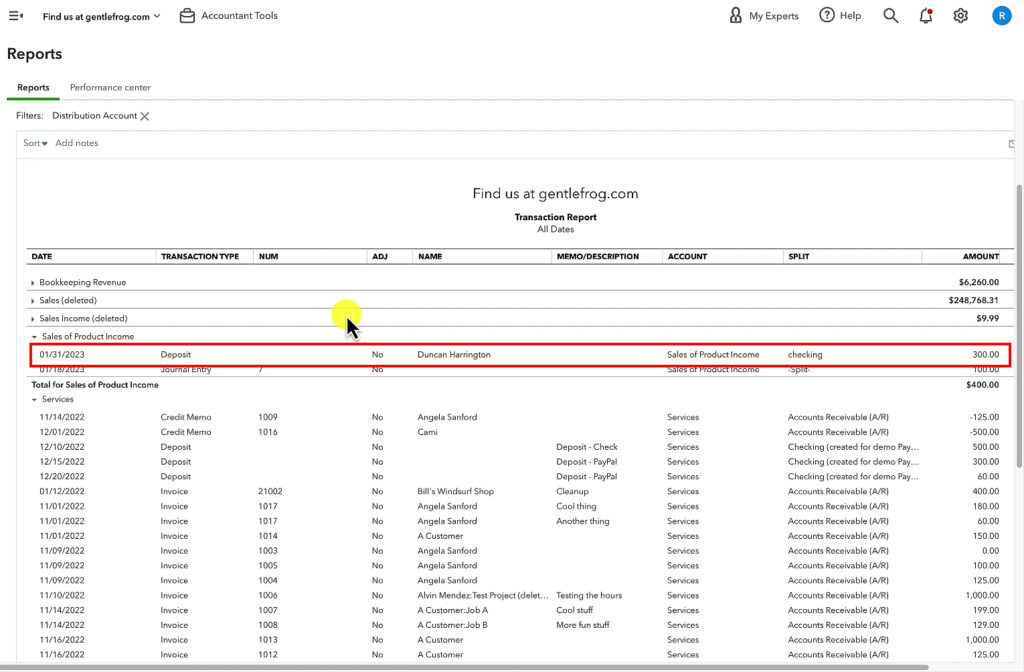

Transaction Report

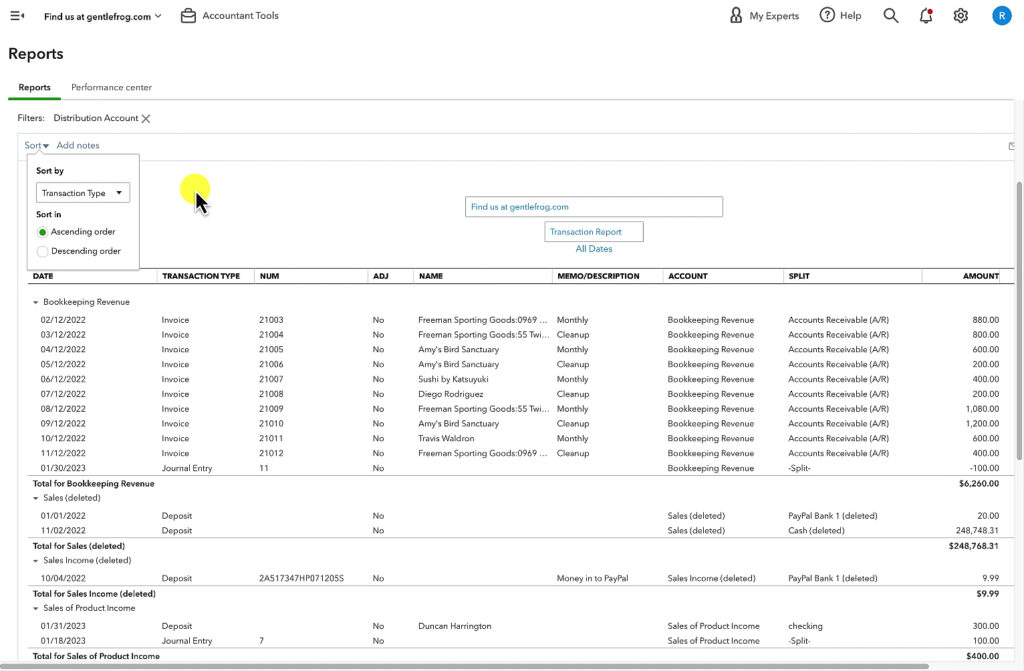

Transaction Report is a list of all the transactions that add up to equal that Total Income amount.

You can scroll through the list and look for anything that looks unusual or doubled.

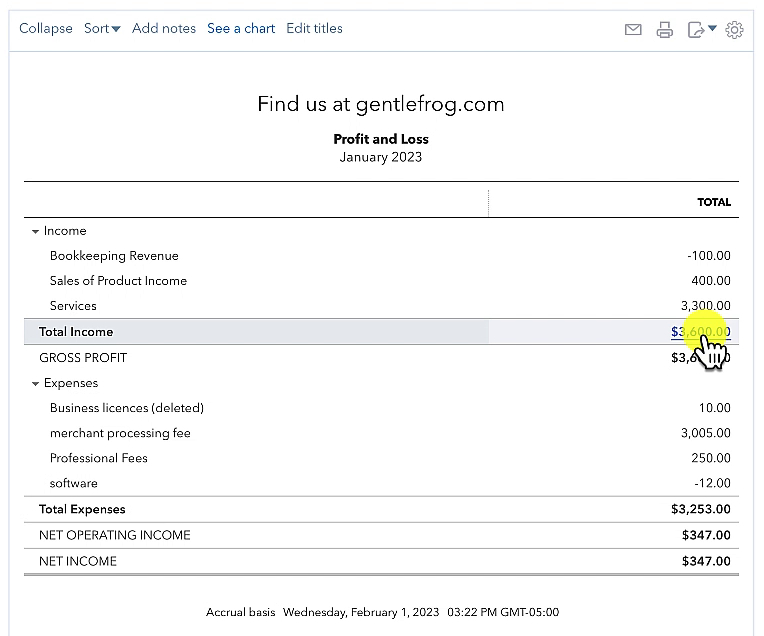

It can be difficult if you have a lot of transactions. To make it easier click Sort towards the upper left. Then Sort by Transaction Type.

Most often the problem is a deposit.

This is because the flow of income is usually:

- Create an invoice or sales receipt

- Payment is received

- Payment is deposited into the bank

One way that income can get doubled is if those first two steps are skipped.

Here’s an example, in my transaction list I see a Deposit of $300 for a client, Duncan Harrington.

I can check whether or not this is a legit deposit by viewing Duncan’s transactions.

Viewing Customer Transactions

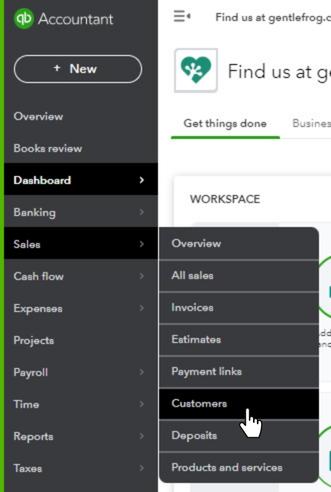

First, we’ll navigate to the customer list by clicking Sales then Customers in the left side menu.

Now I’ll search for Duncan in my customer list.

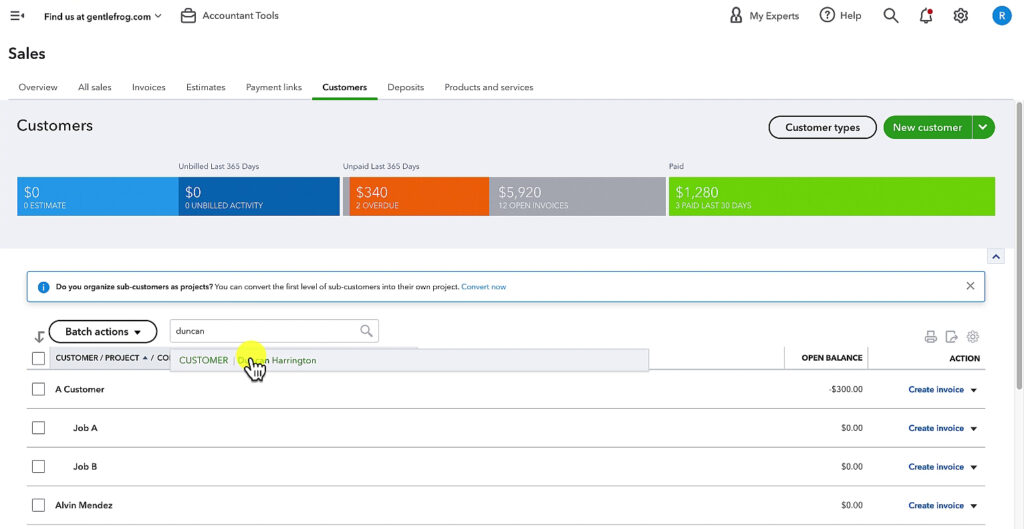

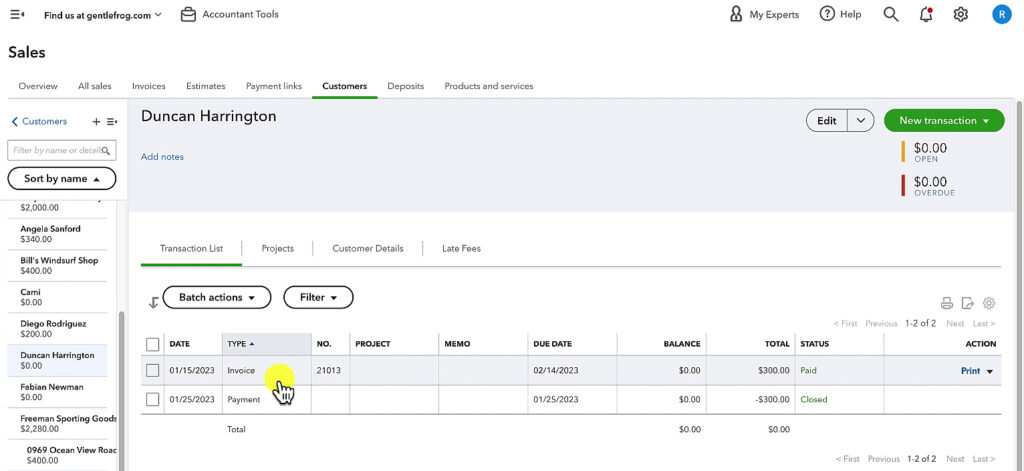

In Duncan’s Transaction List, I can see there’s an Invoice and a Payment both for $300.

If I open the Payment I can see it went into my checking to pay for the invoice on 1/25/23.

If I open the Deposit I found in the Transaction Report I see that same $300 recorded as a deposit into my checking account on 1/31/23.

These are two duplicate records of the same payment.

Checking the Chart of Accounts

The Chart of accounts is another place where you could find or verify that you have doubled income.

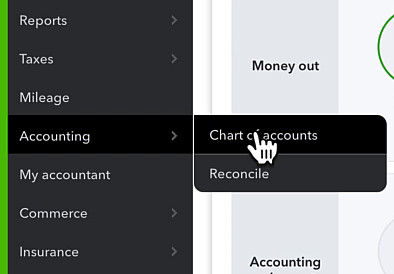

To navigate to the Chart of accounts click Accounting then Chart of accounts in the left side menu.

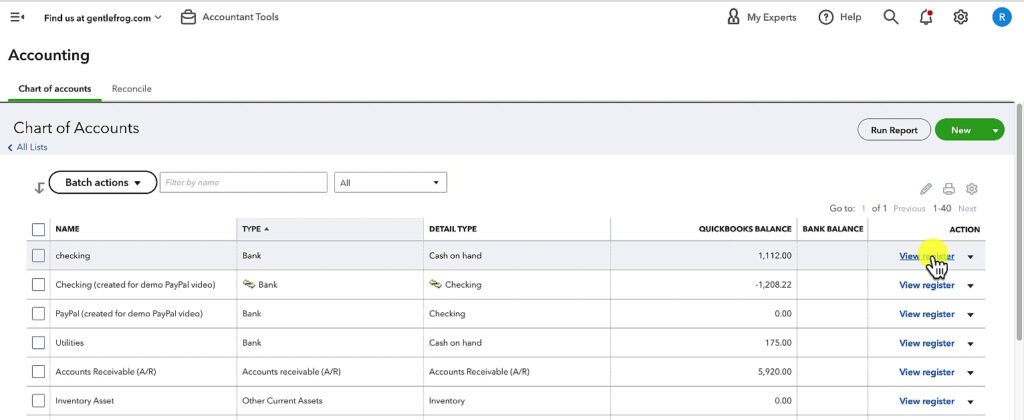

You’ll want to view the register for the account that contains doubled income. In my example, it’s checking so I click view register to the right of my checking account.

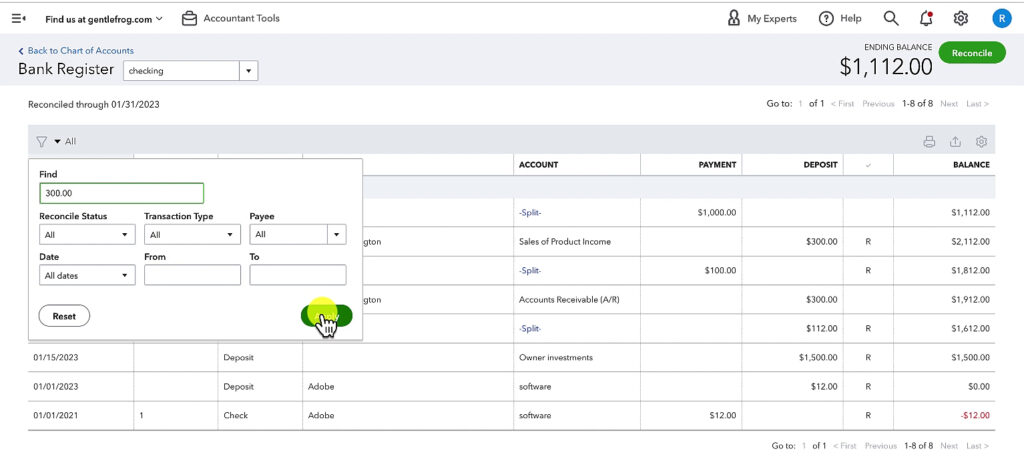

If you have a lot of transactions in your register you can click on the funnel icon in the upper left. In the Find box enter the dollar amount of the doubled income then click Apply.

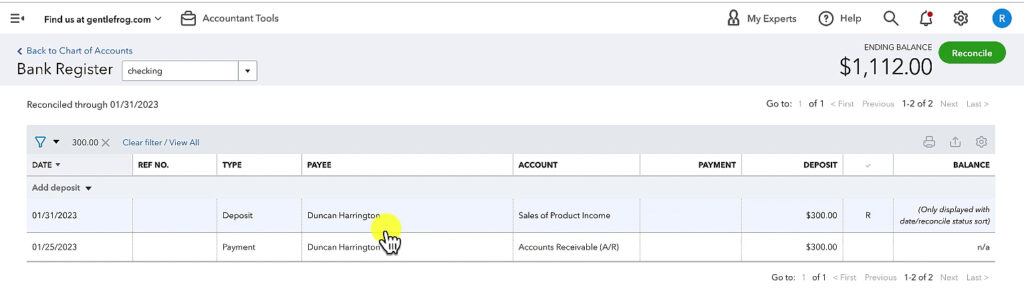

When I do this search I see the doubled income from Duncan.

Now I know for sure that I need to delete one of these.

Deleting Doubled Income

In the screenshot above you may have noticed a little R on the line of the Deposit. This means it’s reconciled.

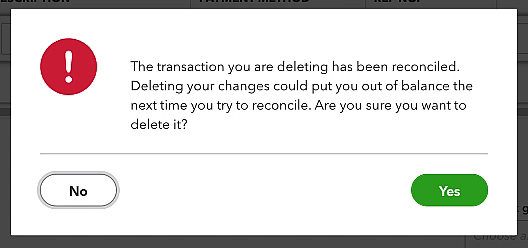

I want to keep the record of the $300 as a Payment towards an Invoice. But I don’t want to delete something that’s been reconciled or I’ll get a warning message:

Move the Payment to Undeposited Funds

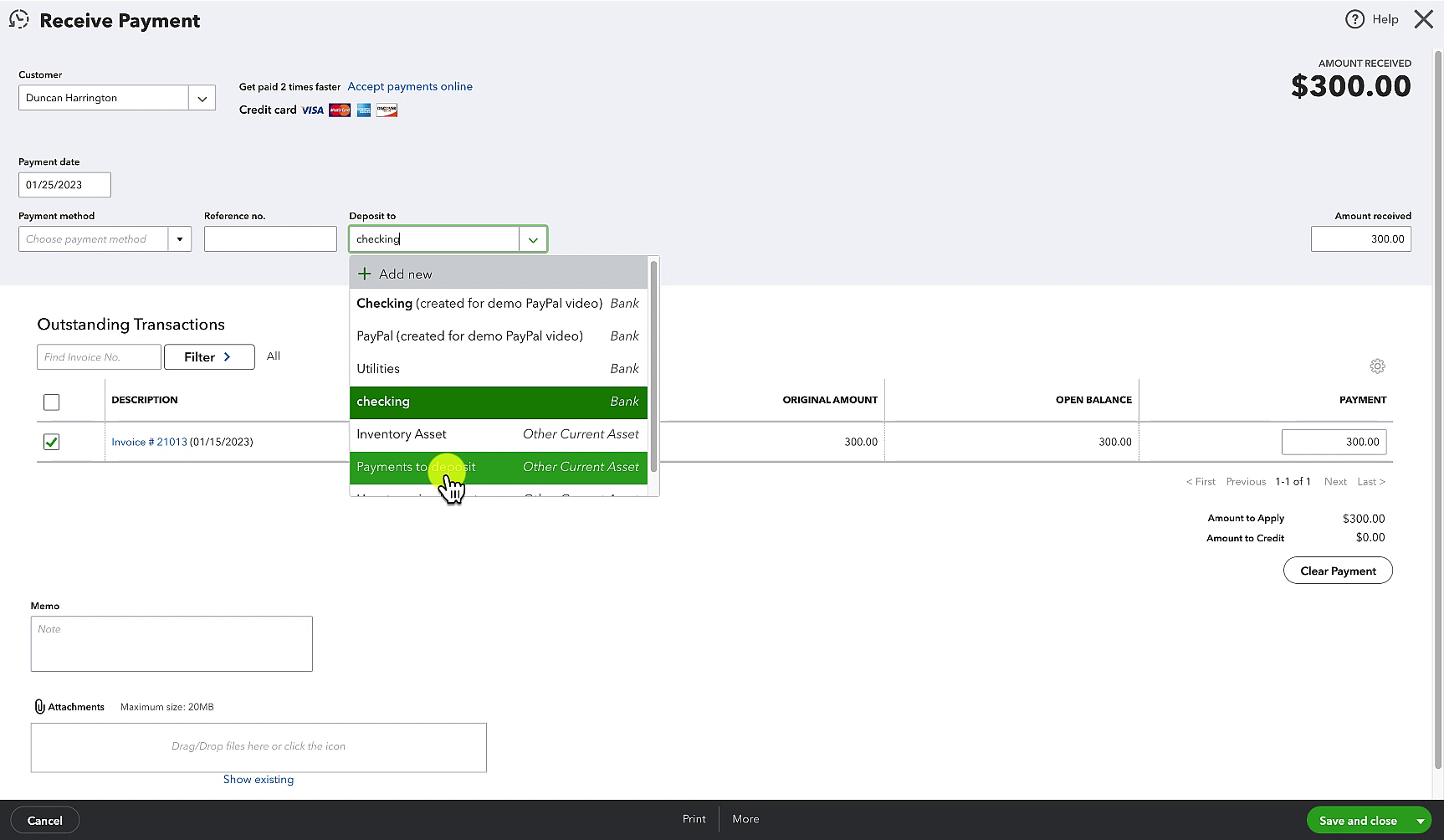

To fix this you’ll open the Payment to the Invoice (that’s the screen that says Receive Payment at the top).

Change the Deposit to from whatever it was (in my example checking) to Undeposited funds (in my account it’s Payments to deposit). Then click the Save and close button.

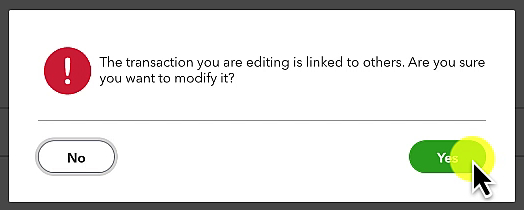

Since this Payment is attached to an Invoice you’ll get a warning message. Click Yes.

All this did is remove the payment from the bank register.

The payment itself still exists and you’ll see it if you view your customer’s transaction list.

But, the doubled income still exists in your Transaction Report. There’s one more step.

Delete the Deposit

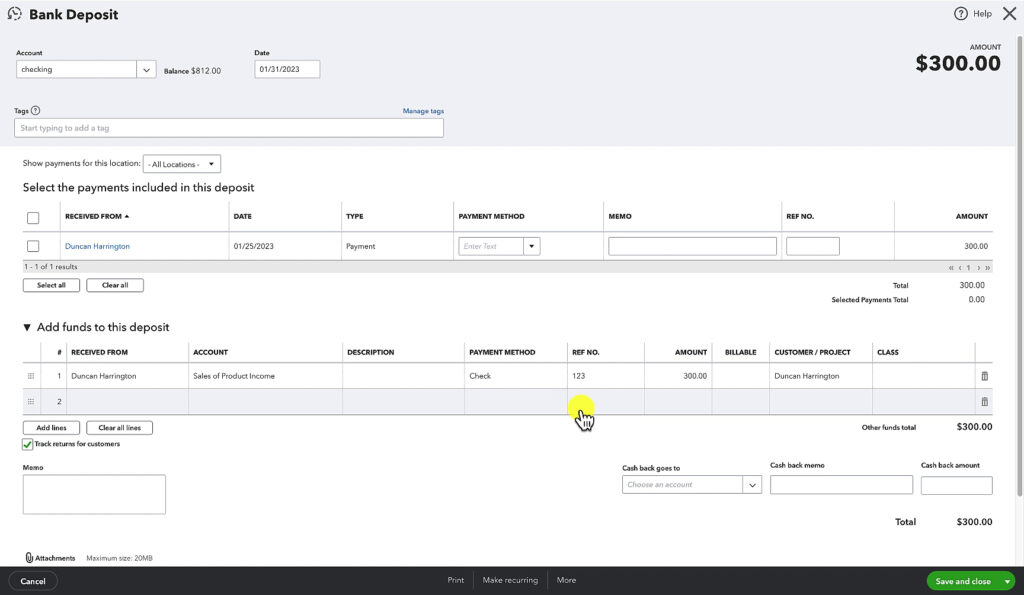

In the Transaction Report I’m going to click to open the original deposit I found.

This is what it looks like:

There’s the Payment at the top and the Deposit at the bottom. To fix this I’ll check off the payment and click the trash can to the right of the deposit to delete it. Then click Save and close.

That warning about editing a transaction that’s reconciled will pop-up. This time I click Yes because the dollar amount has not been changed. I’ve only changed what that check payment was connected to.

Now the deposit is gone and the check payment is correctly connected to the Invoice. Duplicate income fixed!

☕ If you found this helpful you can say “thanks” by buying me a coffee… https://www.buymeacoffee.com/gentlefrog

Below is a video if you prefer to watch a walkthrough.

If you have any questions about duplicate income in QuickBooks online click the green button below to schedule a free consultation.