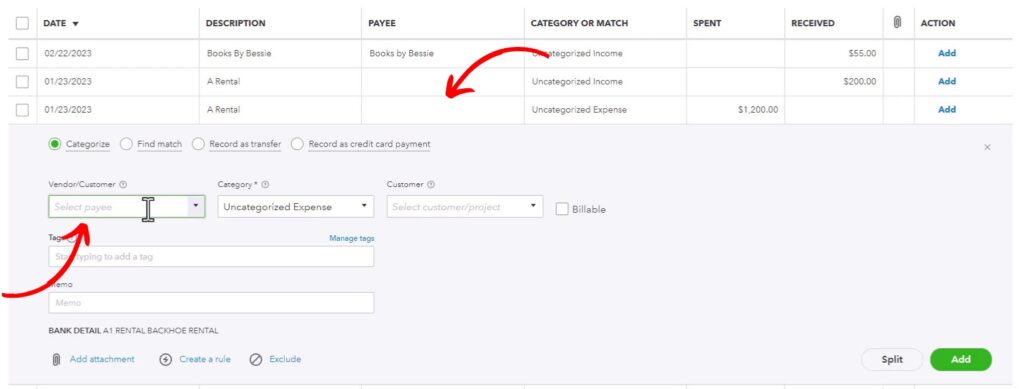

When categorizing transactions in the QuickBooks Online bank feed you’ll often come across transactions with a blank Payee.

The Payee is the Vendor/Customer associated with the transaction.

You can quickly add these to QuickBooks without leaving the bank feed.

Quick Instructions:

- Click a transaction with no Payee

- Click the Vendor/Customer drop-down

- Type the vendor or customer’s name

- Click the Add box

- In the New Name window select a Type

- Click Save

Keep reading for a complete walkthrough with screenshots:

Add a Vendor/Customer From Within the Bank Feed

If you come across a transaction with a blank payee field click on that transaction to open it.

In the Vendor/Customer field in light gray, it will say Select payee.

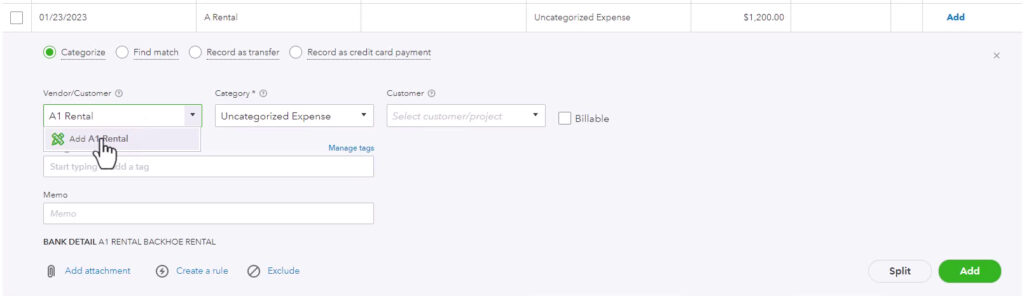

Click the Vendor/Customer drop-down and type the name of the vendor or customer. If no match is found an Add box will appear below the drop-down.

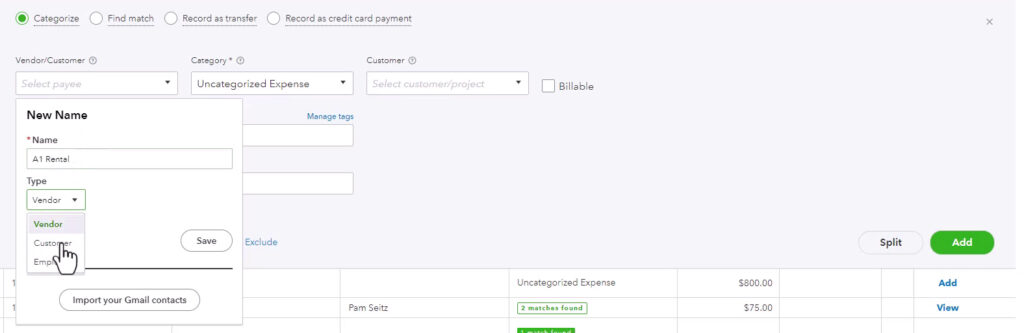

When you click on the Add box the New Name pop-up will appear. The Name field is pre-populated with what you entered in the Vendor/Customer drop-down.

Select the type of Vendor/Customer:

- Vendor

- Customer

- Employee

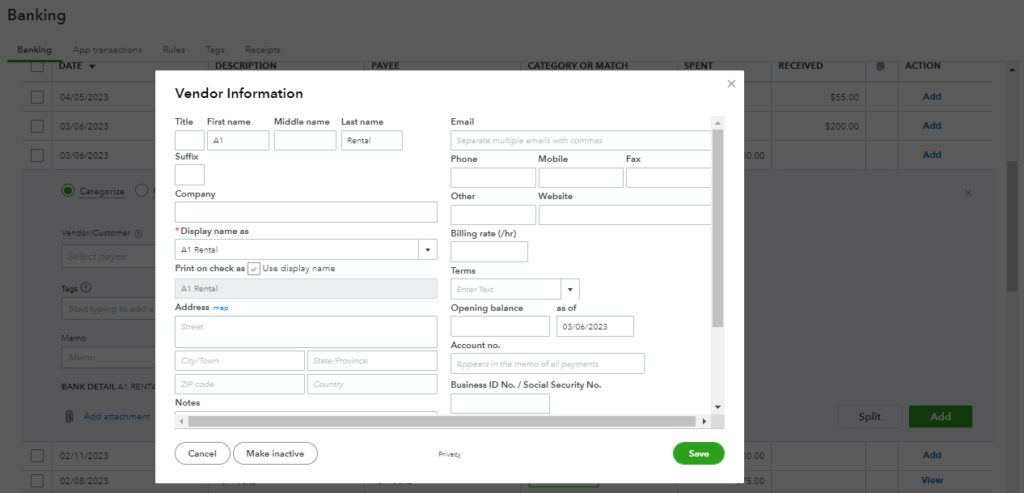

You can click + Details to open the Vendor/Customer/Employee information window. From here you can add as much additional information as you’d like.

You do not need to add any additional information. Your new Payee only needs a Name and Type.

When you’re ready click Save.

You now know how to add a vendor or customer to Quickbooks Online from within the bank feed.

☕ If you found this helpful you can say “thanks” by buying me a coffee… https://www.buymeacoffee.com/gentlefrog

Below is a video if you prefer to watch a walkthrough.

If you have any questions about adding vendors to QuickBooks online click the green button below to schedule a free consultation.