If you’ve recently switched from QuickBooks Desktop (QBDT) to QuickBooks Online (QBO), you might be familiar with the Bill Payment Stub report in QBDT.

This report helps you keep track of payments made to vendors.

QBO calls this report Bills and Applied Payments (Bill Stub, Vendor Check Stub).

While the name and location differ, the functionality remains similar. It allows you to print a list of bills paid with a specific check.

In this guide, I’ll walk you through locating and printing this report in QuickBooks Online.

Quick Instructions:

- Click Reports in the left side menu

- Search for “bill”

- Click Bills and Applied Payments (Bill Stub, Vendor Check Stub)

- Change Report period to date of check

- If needed, Customize and filter by Vendor

Keep reading for a complete walkthrough with screenshots:

Example Of When to Send a Bill Stub

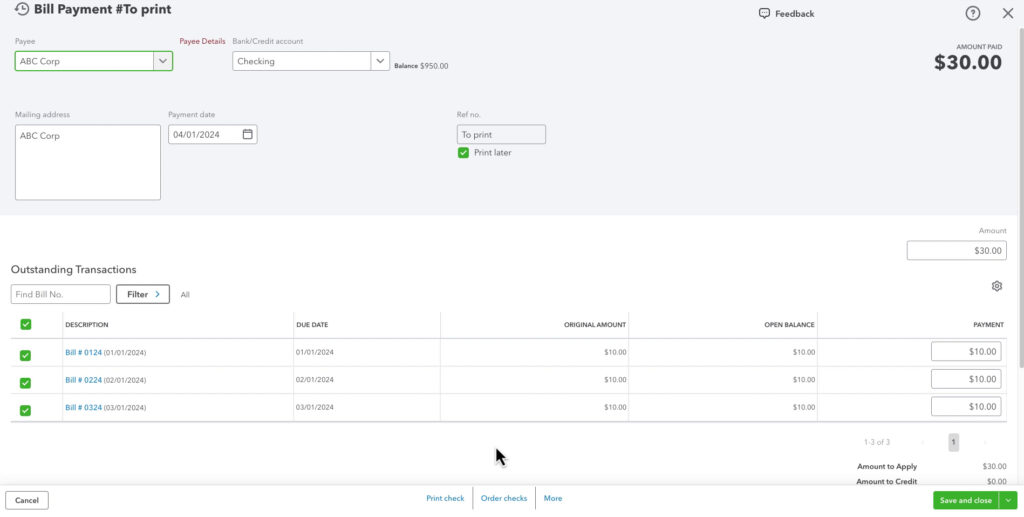

Here, I have an example bill payment made to ABC Corp. It was one check covering three different bills:

When I send the check to ABC Corp, I want to include a list of the bills paid.

The way to do this is using the Bills and Applied Payments Report.

Bills and Applied Payments Report (Bill Stub, Vendor Check Stub)

Click Reports in the left side menu. Then, search for Bills and look for the Bills and Applied Payments report.

The report will show you ALL bills and payments in the selected date range.

To get a list for a specific check, change the report period to the check date.

You can customize the report if you have multiple checks for different vendors on that date.

- Click the Customize button on the right.

- Click the arrow to the left of Filter.

- Check off Vendor.

- Select the vendor from the drop-down.

- Click the Run report button.

You now have a list of bills associated with that check.

You can click the printer icon to print and send a copy with the check. Or save as a PDF and email a copy to the vendor.

Why Printing a Bill Payment Stub Is Useful

Keeping a printed payment stub can be beneficial for various reasons:

- Proof of Payment: A printed is official proof that you’ve paid a vendor.

- Record-Keeping: It helps with record-keeping, especially if you need hard copies for accounting or audits.

- Vendor Requests: Vendors may ask for confirmation that you processed a payment, and you can provide a stub as documentation.

Scroll down if you’d like to watch a video walkthrough of this process.

☕ If you found this helpful, you can say “thanks” by buying me a coffee… https://www.buymeacoffee.com/gentlefrog

If you have questions about QuickBooks Online, click the green button below to schedule a free consultation.