If you use cash basis accounting, you may see an Unapplied Cash Payments account in QuickBooks. This account is automatically created by Quickbooks Online for cash basis reporting. You cannot delete or change it.

You’ll never use this account directly on any purchase or sales form.

The account is required by the IRS for proper reporting of “Constructive Receipt Income.” If you’d like to learn more see IRS Publication 538.

What is Unapplied Cash Payment Income

The Unapplied Cash Basis Income account is used to report income from customer payments that are received but not applied to any sales form (invoices, sales receipts, deposits).

Simply put – you took money in, but never declared the income on a sales form.

Here’s what it will look like on the Profit and Loss Report:

Usually, what’s happened is a payment has a date that’s before the date of the invoice date it’s applied to.

Example: Receive payment today, invoice next month. It’s “unapplied” until next month when the invoice hits the books.

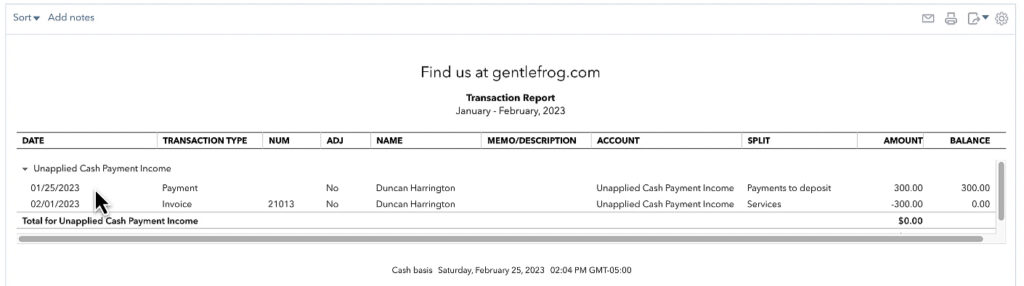

Here’s an example of a transaction report showing just that:

The payment was received on 1/25/23 but the invoice wasn’t created until 2/1/23.

Remove Unapplied Cash Payment Income From Your Profit and Loss

If you don’t like seeing Unapplied Cash Payment Income on your Profit and Loss you can remove it. All you have to do is change the date of the invoice to before the date of the payment.

☕ If you found this helpful you can say “thanks” by buying me a coffee… https://www.buymeacoffee.com/gentlefrog

Below is a video if you prefer to watch a walkthrough.

If you have questions about Unapplied Cash Payment Income in QuickBooks Online click the green button below to schedule a free consultation.

2 Responses

Rachel – Setting up QB for new business. This was a great explanation. Straight to the point and understandable example. Thank you.

This was so helpful and easy to follow.

Thank you for this!