In today’s blog post, I want to show you how to add the Bank of America, Alaska Airlines Credit Card to your books.

Let’s dive right into it and add the account to your Bank Feeds in QuickBooks Online. You should take note that this isn’t an account in your Chart of Accounts, it’s just an account that will be linked into these bank feeds and will show up as an additional tile in your banking screen. For more in-depth information on how to use bank feeds, check out our previous blog post here.

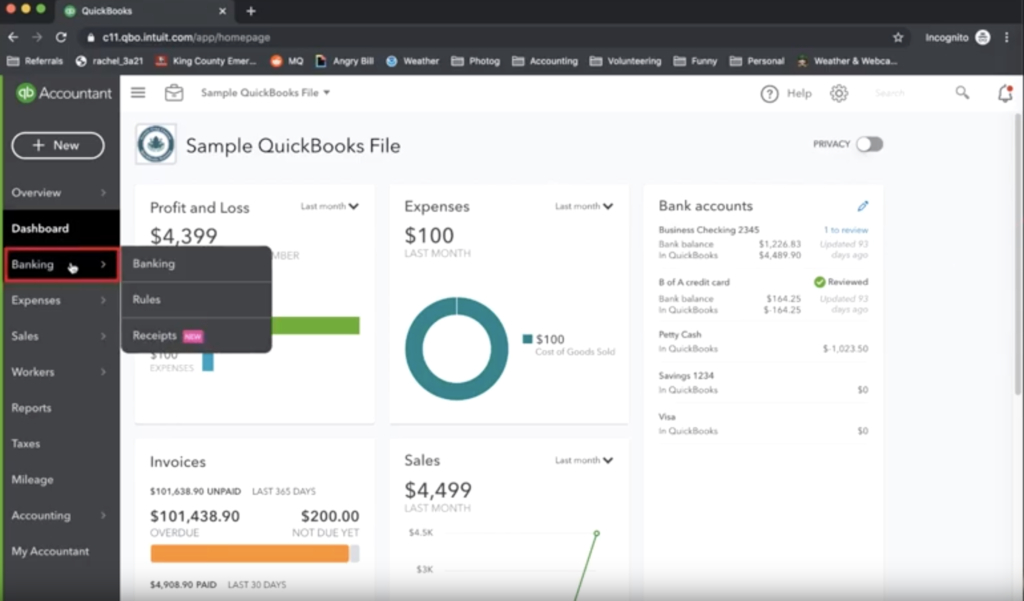

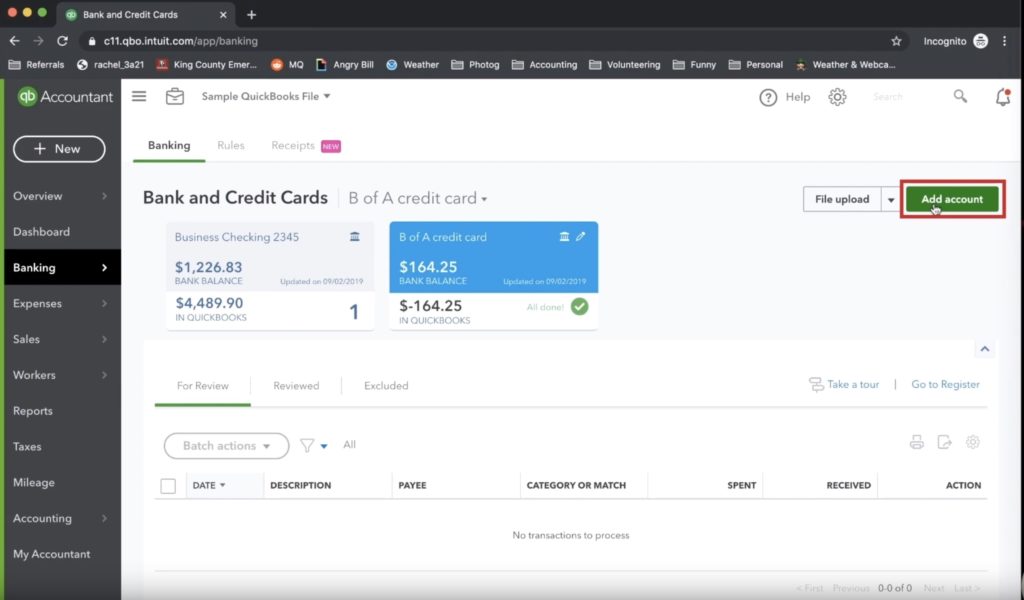

To add the account to your bank feeds, start by navigating to the dashboard and finding the banking button on the left-hand navigation menu and click it. Doing that will take you to your banking dashboard. Now on the right-hand side of the screen, click Add Account. Again, this isn’t adding to your chart of accounts, but it will prompt us to add the appropriate bank feed.

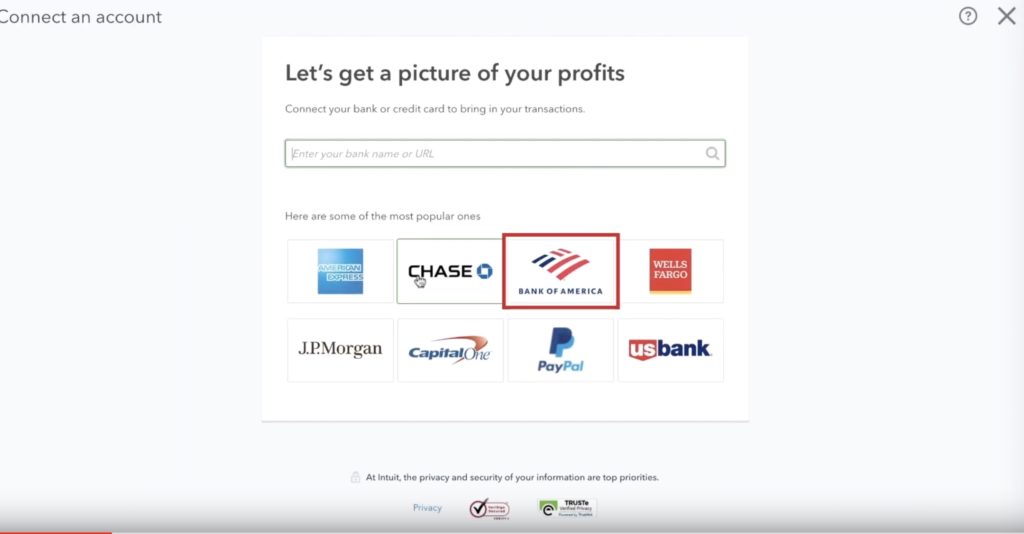

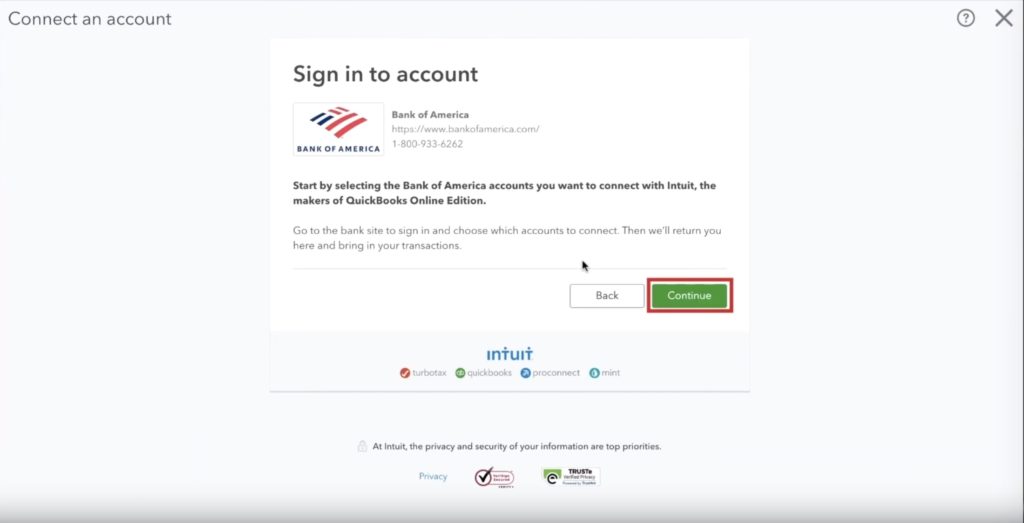

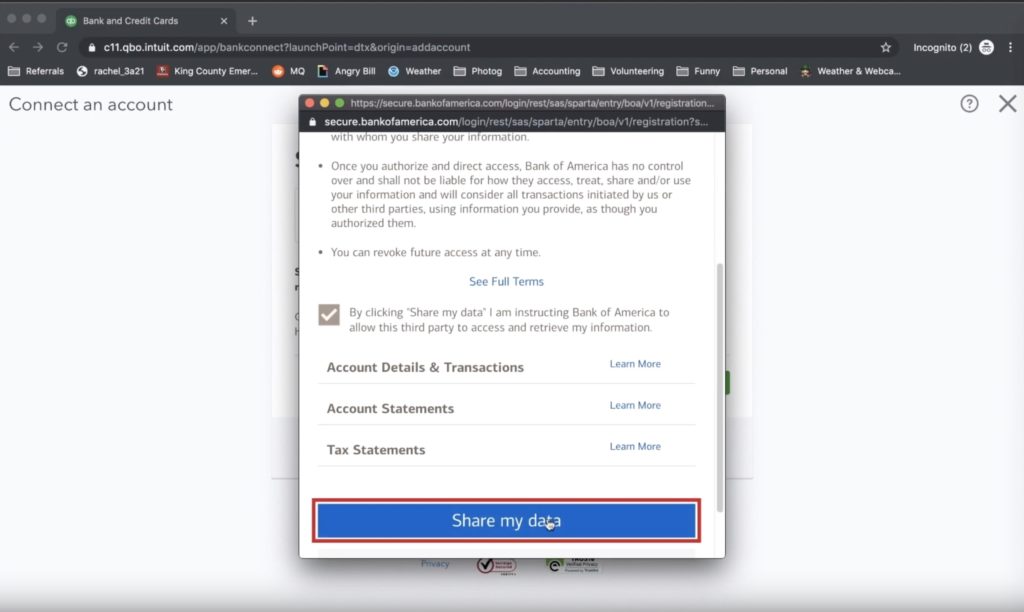

So after we’ve clicked the Add Account button, we’ll need to tell QuickBooks about our banking information. You will now see a screen that has several banks from which to choose. In this example, we’re setting up a Bank of America credit card, so we’ll pick Bank of America. Once we pick Bank of America, we’ll have to sign in to our bank account to grant QuickBooks access to the information it contains. Click the green continue button. An additional screen will then pop up where you’ll need to provide consent to share your data from Bank of America to Quickbooks.

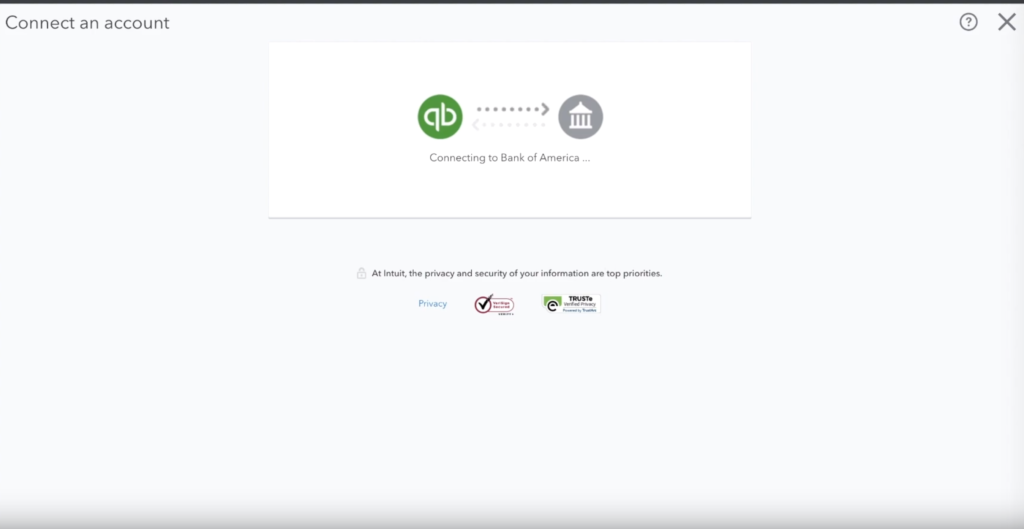

Following the steps above will set up the connection between the two services. If the screen loads that says “Connecting to Bank of America,” then you know you’ve done it right.

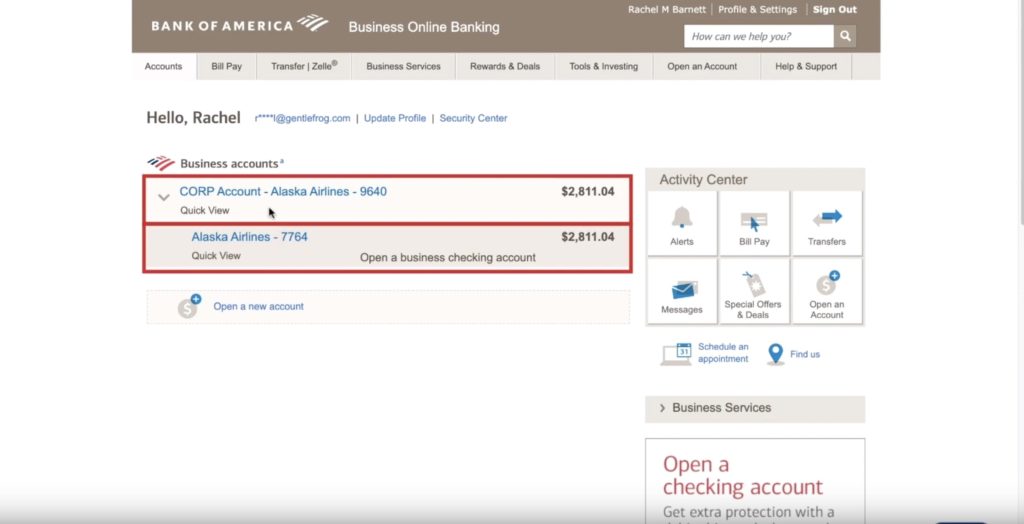

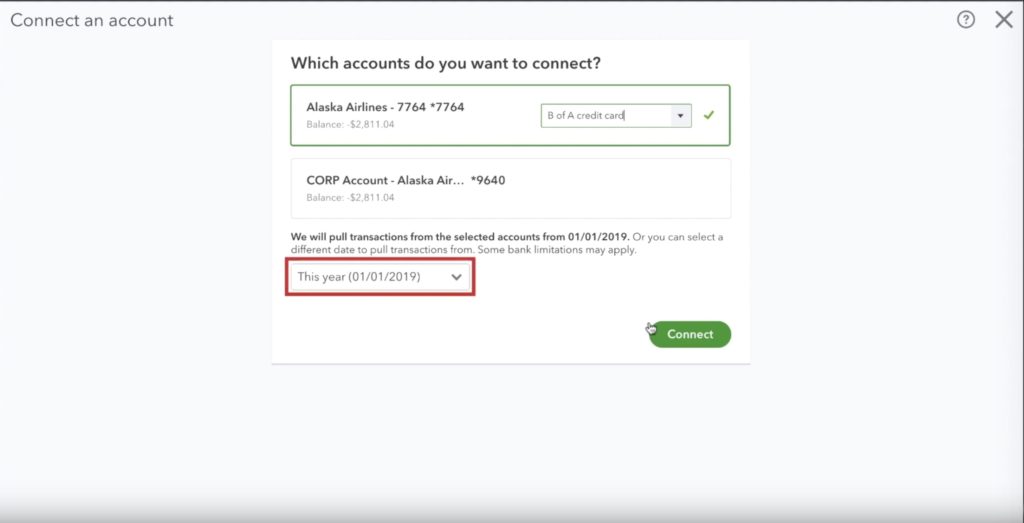

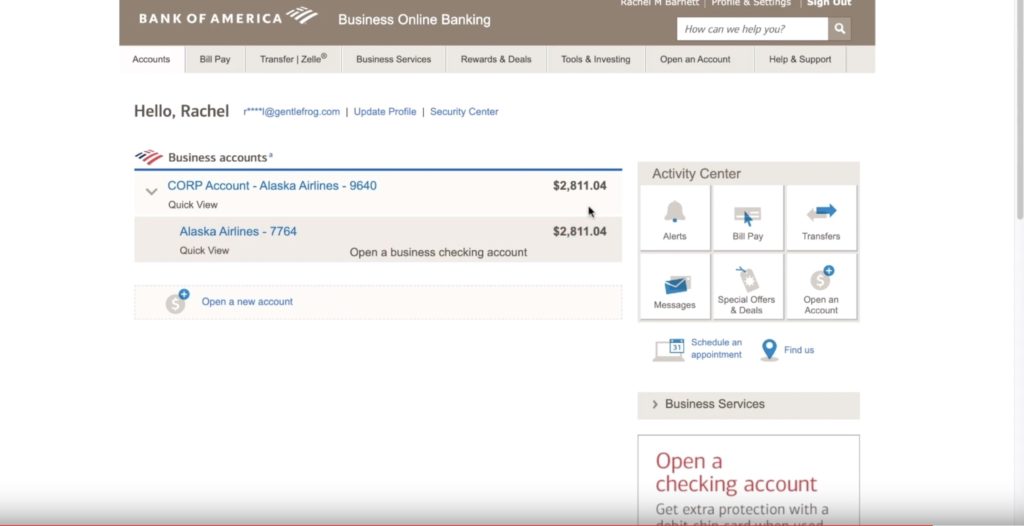

In our case, we have more than one account in Bank of America. The screenshot below shows how it looks. There is an account ending in 9940 and one ending in 7764.

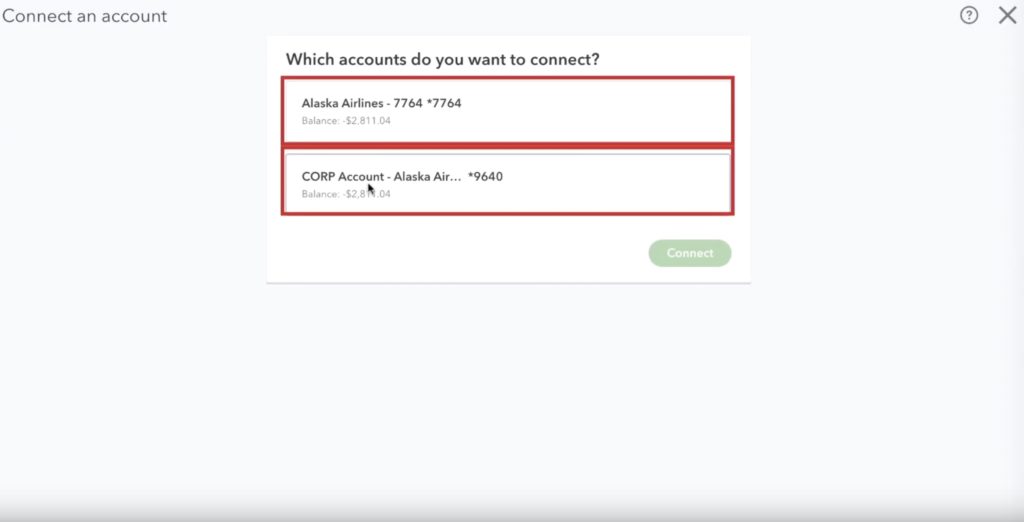

And when we go to QuickBooks, we will also see the same accounts. We now need to tell QuickBooks which one we want to connect.

In this example, the account we are linking is the one ending in 7764, not the corporate account. You might instinctively want to download the data from the corporate card. However, all of our transactions are processing through the Alaska Airlines 7764 card account.

We have identified which is the correct account, and now we need to select it in QuickBooks. Once you highlight the correct account, QuickBooks will ask you to pick a beginning date to load your transactions. For this example, the date will be 01/01/2019. And finally, click the green Connect button.

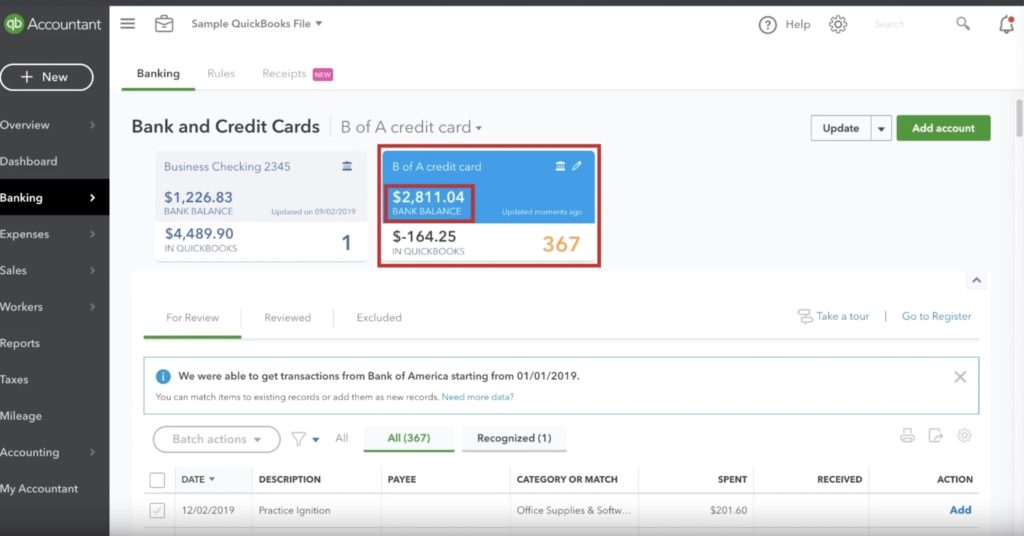

At this point, all of the connections are established. You can confirm the connections by viewing the banking screen and confirm that the balance of the connected account is the same as the balance in your Bank of America Account. In this case, both are $2,811.04

You will notice that there are 367 transactions that we need to deal with. I go over how to deal with those transactions in a previous blog post here.

Thank you for reading the blog post. If you have any questions, please leave a comment below.

☕ If you found this helpful you can say “thanks” by buying me a coffee…

https://www.buymeacoffee.com/gentlefrog

If you would like to see some video instruction on how to undertake this task, you can view that below as well.

3 Responses

My client has ONE credit card account with Bank of America , but the “two” accounts (as above) show up as separating the payments applied. The problem I am running into is that the one account is where all the payments are logged, and the other doesn’t apply the payments to it. So in quickbooks online, do I have to make a journal entry to let it know that the payments are actually applied to the one “card?” Does this make sense? This is really confusing and I don’t know what to do. I accidentally made both accounts credit cards so that isn’t right. I originally had made one account the main account and then added the other as the subaccount (which I will need to do when they add employee cards). What am I missing? I wish there was just a step by step process for this type of thing. Basically Chase checking pays the “credit card” (the account that doesn’t show charges only payments) but it doesn’t apply it to the “credit card” account that shows all the purchases. I feel like I have to transfer the money one more time to apply it to the other account to balance it all out in bank feeds/chart of accounts etc. Help!

Hi Marci,

With Bank of America when there’s only one physical credit card we suggest connecting the card that is in the pocket, not the corporate card. Have only this one card in the Chart of Accounts. Apply all payments to this one card. No journal entries are necessary. No subaccount. If you’d like, someone from the team can walk you through it in a 15-minute meeting: https://www.gentlefrog.com/meeting/

We’ll also put this in the list of upcoming video topics as it’s not uncommon.

-Jess

Thank you so much for your reply! Guess what? They just added a second employee card 🙂 When I go to Banking and try to connect it to QB, the new card doesn’t appear as an option. It only has the original card and CORP. Should I just manually enter all transactions for this other employee card or am I missing something with Bank of America? (The CORP card also has the late fees attached to it and not the employee card!) I can’t tell you how thankful I am that you replied.

THE MESS: I had connected the CORP card to bank feed and was manually adding CHARGES for the same amount as the PAYMENT so it would apply to the physical credit card’s “balance” in QB. Needless to say, I have created a mess! And the “balance” of the CORP card of course includes the new employee card, so it’s all confused. Good grief.

I am thinking I will delete all transactions from the CORP card and make it inactive, and then apply all CC payments from Chase Checking to the credit card account? I tried to manually import the transactions from BoA, and QB gave me an error that it’s not a valid .QBO file (even though it is?) Thank you so very, very much.